862 billion dollars in debt in limbo & your jumbo loan might not close

862 billion dollars in debt in limbo & your jumbo loan might not close

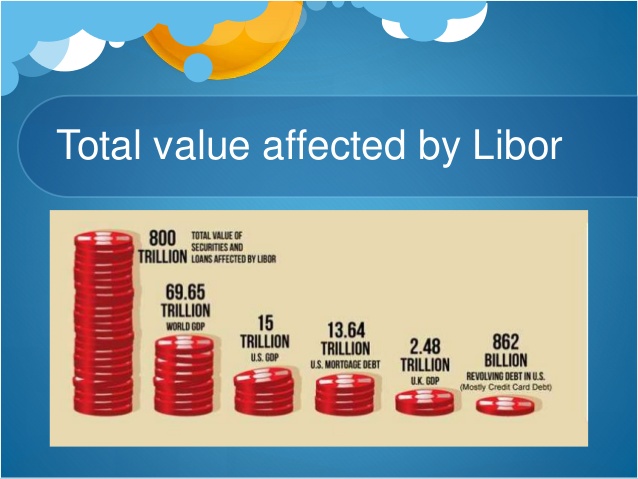

Today it was announced that Libor will be phased out by 2021. Why is this such big news? According to a fed survey almost 45% of mortgages are linked to Libor and the vast majority of jumbo loans are Libor based. In total there is about 862 billion in short term debt in the US linked to libor (credit cards, car loans, etc…) With the index going away what does this mean for mortgages? Immediately (starting this morning) I suspect banks will pause on issuing Libor based instruments due to the uncertainty of the index. This could impact any loans set to close in the short term. I’ve outlined the immediate impacts and long-term impacts of this key index going away.

Why will a bank stop issuing Libor instruments? Libor is an index. When a security is issued (mortgage or other instrument) there is spread (ie Libor +250) that allows the rate to float. This takes out interest rate risk to the security purchaser/holder. For example, a mortgage would reset based on fluctuations in Libor. This would ensure that the bank would not have to absorb an increase in rates which would in turn reduce their profit. I suspect lenders will stop issuing Libor based mortgages/securities today since there is great uncertainty as to what replaces Libor and there is uncertainty in the markets of how to price this risk. For example, what happens on an adjustable rate mortgage that resets in 6 years from now? There is nothing in the mortgage highlighting an alternate rate or spread.

Why is Libor going away? Libor stands for London Interbank Overnight rates, it is supposed to be similar to the US treasury overnight rate. During the last financial crisis Libor was rigged. This occurred as traders intentionally swayed the rate so that they could profit. Libor is not a market rate, it is a reported rate by various banks as opposed to the fed funds rate which is based on actual market transactions. After the rigging of Libor, changes were made that never fully brought back the volume to Libor, this thin volume has basically doomed the index. Unfortunately, with the announcement today it is a self-fulfilling prophecy that will further undermine the index.

“The impact of this decision from the FCA is to put uncertainty into all Libor-based swap rates,” said Peter Chatwell, head of European Rates Strategy at Mizuho International Plc in London. “The market will need guidance as to what a replacement could be and this will lead to increased volatility and possibly reduced liquidity in the near term.”

What will happen to Libor based instruments? This was my biggest question since I took out an adjustable rate mortgage based on Libor that is not resetting for another 6 years. Here are some options:

- Libor is replaced. It is likely Libor will be replaced but the new index will be different than the old index, will this new index be higher or lower? If you have a mortgage how will the bank calculate the new rate? How will the purchasers of the mortgage handle a change in their anticipated return? Unfortunately, if a new index is implemented you can’t go back in time and adjust the rate so there is considerable uncertainty

- Mortgages use a new index. Will the financial instruments pick a new index on reset? Possibly, but what is a fair rate to pick? How do you determine the rate, spread, etc… Libor historically has not acted in tangent with treasuries. I suspect that very few if any new securities will be issued with Libor as an index with any resets beyond 2021

- Lots of litigation! This is the most likely outcome since banks/financial issuers will likely try to choose a scenario more profitable to them and borrowers will look to protect their interests.

What should you do? I would not enter into any transactions that are libor denominated until there is more clarity since there is so much uncertainty on the index